Brighter Outlook Lifts Â鶹app Sentiment

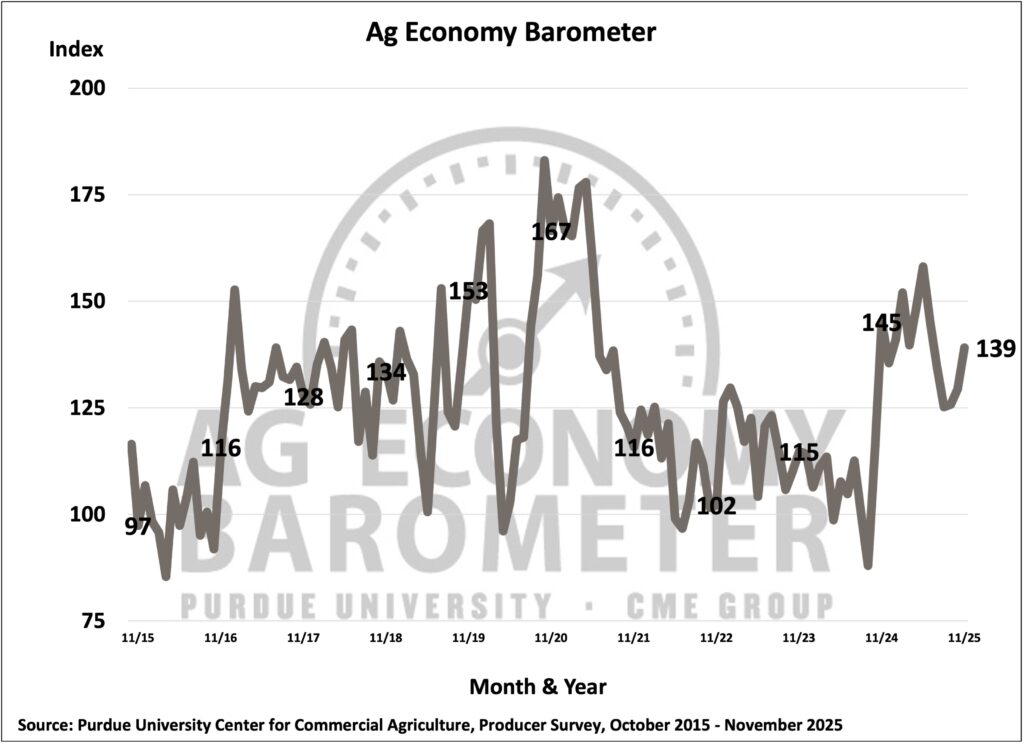

The Purdue University-CME Group Ag Economy Barometer Index climbed to 139 in November, 10 points higher than in October and the highest barometer reading since June of this year. The improvement in farmer sentiment was attributable to producers’ more optimistic outlook for the future, as the November Future Expectations Index reading of 144 was 15 points higher than in October, whereas the Current Conditions Index fell 2 points to a reading of 128. This month’s survey was the first survey conducted since the late October announcement of a trade pact between the U.S. and China that included provisions for increasing U.S. exports of agricultural products to China, and survey respondents were notably more optimistic about future prospects for U.S. agricultural exports. Sentiment was also buoyed by a sharp rise in crop prices from mid-October to mid-November.

Producers in November were more optimistic about their farms’ financial performance than a month earlier, as the Farm Financial Performance Index climbed 14 points to a reading of 92. In particular, the percentage of producers who expect better financial performance this year rose to 24% from just 16% in October. A sharp rise in crop prices from mid-October to mid-November was a key reason behind the expectation for better financial performance.

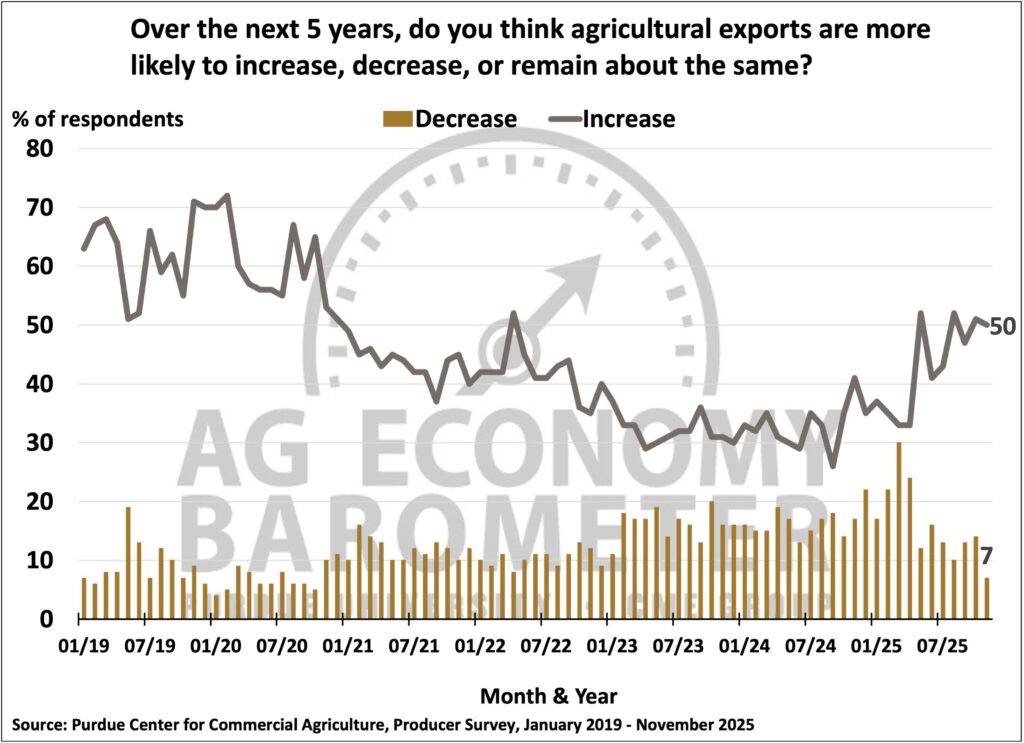

Producers became more optimistic about future agricultural trade prospects in November. Responding to a question included in every barometer survey since January 2019, just 7% of respondents said they expect U.S. agricultural exports to weaken in the next 5 years, down from 14% who felt that way in October and down from 30% who expected exports to weaken back in March. In a related question, 47% of corn producers responding to the November survey said they expect soybean exports to rise over the next 5 years, while just 8% said they expect soybean exports to decline. The improved trade outlook appeared to contribute to this month’s sentiment improvement.

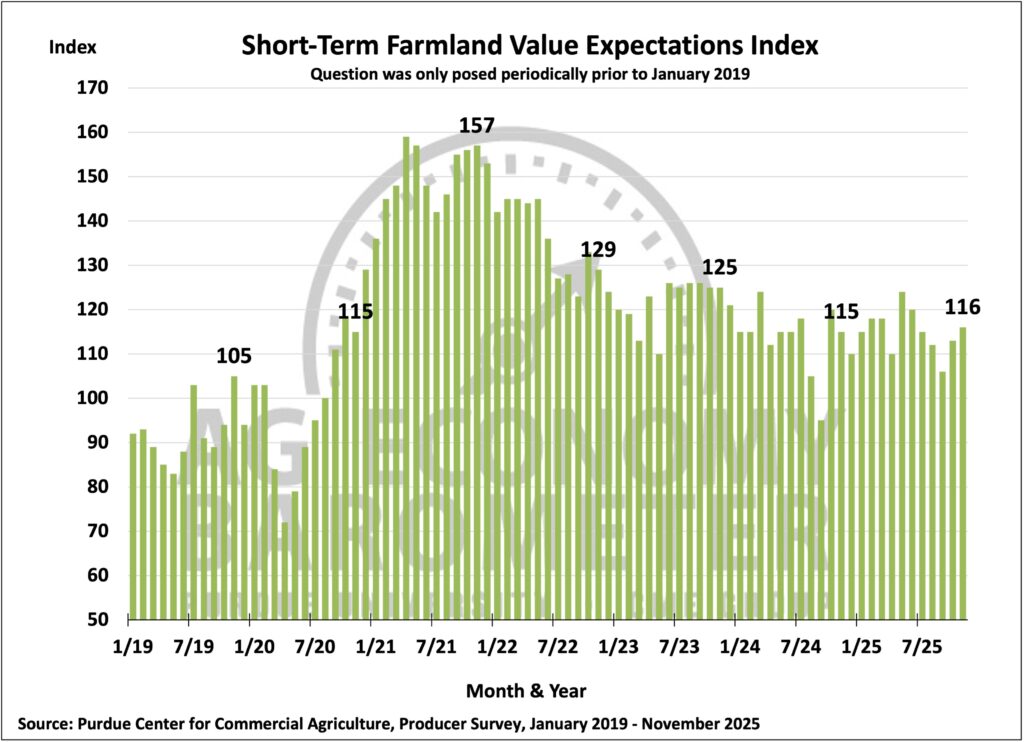

For the second month in a row, the Short-Term Farmland Value Expectations Index rose, reaching 116 in November, 3 points above a month earlier and 10 points higher than in September. Â鶹apps’ long-run perspective on farmland values also rose this month as the Long-Term Farmland Value Expectations Index climbed 4 points to a reading of 165, a new record high for the index. This month’s survey also asked corn producers about their expectations for cash rental rates for farmland in 2026. Nearly three-fourths of respondents (74%) said they expect rates in 2026 to be about the same as this year, which was very consistent with responses received in both July and August. The relatively strong cash rent outlook provides some support for farmland values.

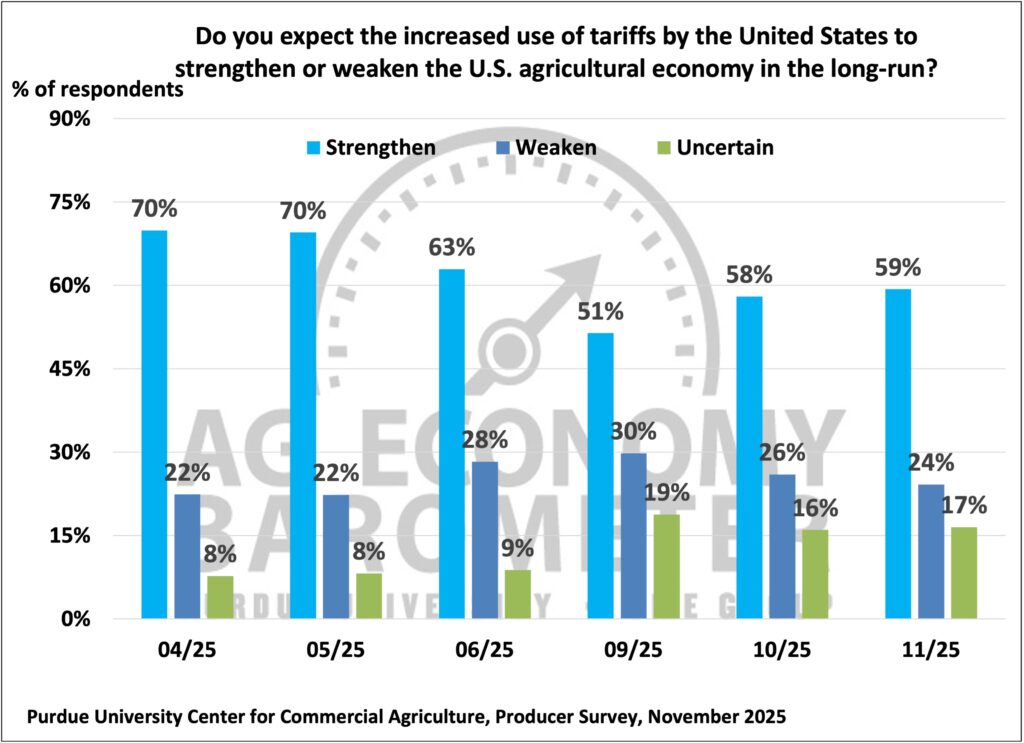

Recent barometer surveys have included two questions that focus on farmers’ attitudes regarding 2025’s policy shifts. A majority of respondents, 59% in November and 58% in October, said they expect that use of tariffs by the U.S. will ultimately strengthen the agricultural economy. However, that is lower than last spring, when 70% of respondents said they expected tariffs to strengthen the agricultural economy in the long run. More producers in recent months reported being uncertain regarding the long-run impact of the U.S. tariff policy. In October and November, 16% and 17% of survey respondents, respectively, said they were uncertain about the impact that tariff policy will have, roughly double the 8% of respondents who felt that way in April and May. Meanwhile, two-thirds (67%) of farmers in the November survey said the U.S. is headed in the “right direction”, down from the 72% who felt that way in October.

Wrapping Up

Â鶹app sentiment improved in November, with the rise attributable to an improvement in the Index of Future Expectations. Strengthening crop prices contributed to the improved outlook for the future, as did a more optimistic outlook for agricultural exports. Producers were more optimistic about farmland values in both the short and long run this month. A majority of producers expect U.S. tariff policies to prove beneficial to the agricultural economy in the long run, but the percentage of respondents who said they are uncertain about the impact was roughly double the percentage who said they were uncertain last spring. Finally, two-thirds of producers said that “things in the U.S. today are headed in the right direction”, but that was lower than a month earlier, while the percentage who chose “wrong track” rose from 28% to 33%.

Source: