Brighter Outlook Drives Â鶹app Sentiment Higher

The Purdue University-CME Group Ag Economy Barometer Index climbed to 139 in November, 10 points higher than in October and the highest barometer reading since June of this year. The improvement in farmer sentiment was attributable to producersâ more optimistic outlook for the future, as the November Future Expectations Index reading of 144 was 15 points higher than in October, whereas the Current Conditions Index fell 2 points to a reading of 128.

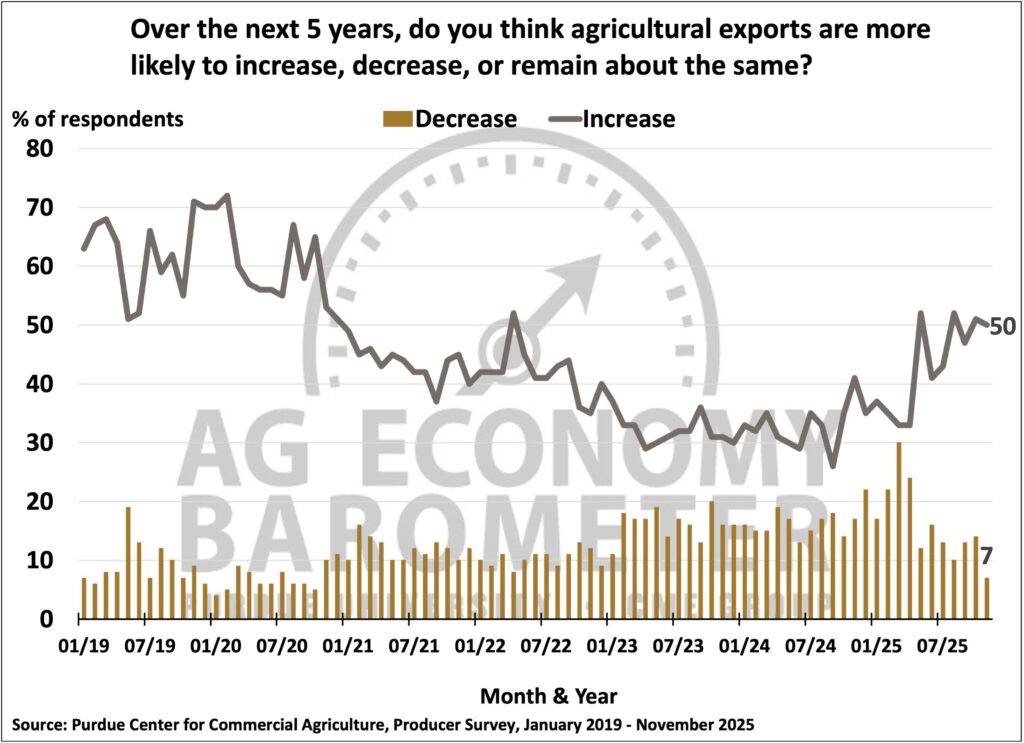

This monthâs survey was the first survey conducted since the late October announcement of a trade pact between the U.S. and China that included provisions for increasing U.S. exports of agricultural products to China, and survey respondents were notably more optimistic about future prospects for U.S. agricultural exports. Sentiment was also buoyed by a sharp rise in crop prices from mid-October to mid-November.

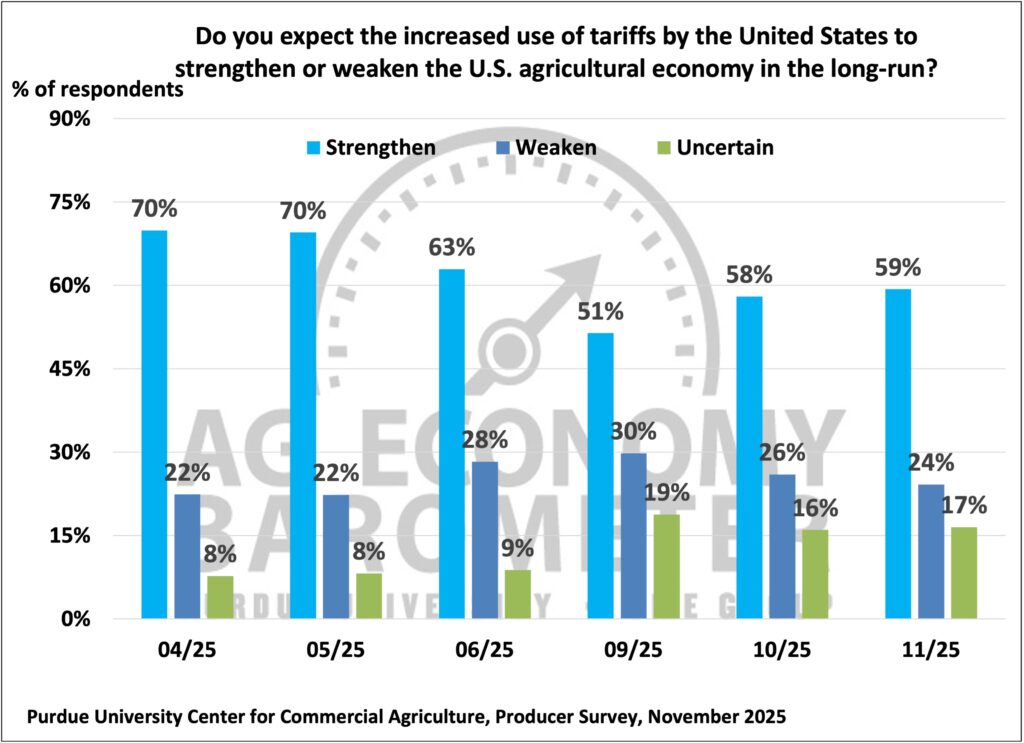

Recent barometer surveys have included two questions that focus on farmersâ attitudes regarding 2025âs policy shifts. A majority of respondents, 59% in November and 58% in October, said they expect that use of tariffs by the U.S. will ultimately strengthen the agricultural economy. However, that is lower than last spring, when 70% of respondents said they expected tariffs to strengthen the agricultural economy in the long run. More producers in recent months reported being uncertain regarding the long-run impact of the U.S. tariff policy. In October and November, 16% and 17% of survey respondents, respectively, said they were uncertain about the impact that tariff policy will have, roughly double the 8% of respondents who felt that way in April and May. Meanwhile, two-thirds (67%) of farmers in the November survey said the U.S. is headed in the âright directionâ, down from the 72% who felt that way in October.

Summary

Â鶹app sentiment improved in November, with the rise attributable to an improvement in the Index of Future Expectations. Strengthening crop prices contributed to the improved outlook for the future, as did a more optimistic outlook for agricultural exports. Producers were more optimistic about farmland values in both the short and long run this month. Most farmers continue to think it is likely that they will receive supplemental income support from the USDA in the form of an MFP payment if prices are negatively impacted by U.S. tariff policies. A majority of producers expect U.S. tariff policies to prove beneficial to the agricultural economy in the long run, but the percentage of respondents who said they are uncertain about the impact was roughly double the percentage who said they were uncertain last spring. Finally, two-thirds of producers said that âthings in the U.S. today are headed in the right directionâ, but that was lower than a month earlier, while the percentage who chose âwrong trackâ rose from 28% to 33%.

Read the full report here: